**Applications are now closed and will be re-opening again early November 2024.**

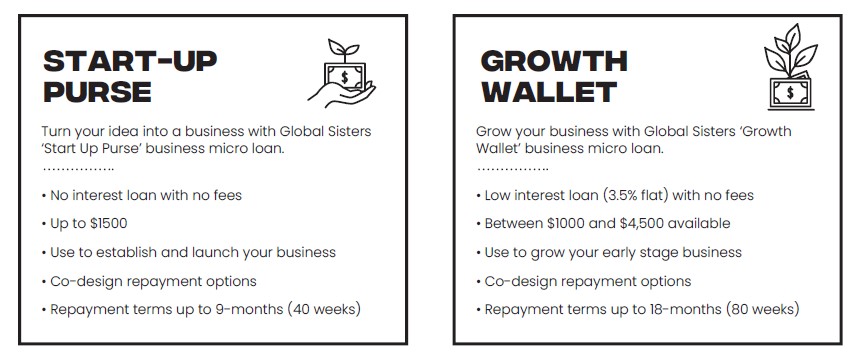

Global Sisters recognises that for micro businesses to thrive, having access to financing options makes all the difference. Global Sisters have created right-sized, affordable no and low interest business loan options specifically for early stage micro business. The Business MIcro Loan Program offers two products: The Start Up Purse and the Growth Wallet.

The Global Sisters business micro loans program does not stand alone — it is integrated with the ‘end to end’ services in business education, coaching, technology and sales channels. We call this ‘relational’ micro lending.

The Global Sisters Business Micro Loan Program takes applications on a quarterly basis only. Please refer to the brochure for up to date information on the loan options and process.

Content

The Global Sisters Business Micro Loan Program is available for business purposes only. When applying for a business micro loan, there are a number of key documents you will be required to provide, including identification, proof of individual income and business financials. Applications for finance are subject to Global Sisters eligibility and suitability criteria and normal credit approval processes.

To be eligible, Sisters must:

- Be over 18 years of age

- Have an existing, active Global Sisters member. Has completed at least one of the following within the last 12 months: (a) Sister School; (b) Financial Pathways Program

- Have an active ABN

- Clearly articulate the business financing need

- Demonstrate capacity to repay within the allocated loan term, without causing household financial hardship

- Provide all documentation and information requested within the loan application process

- Have an established business bank account (separate to household or personal bank account) that will be set up to manage the direct debit repayment

- If application is successful, agree to provide Global Sisters with verified visibility on credit score at both loan disbursement and at completion of loan repayment period

Business loans cannot be used for: non-business purposes including emergency relief, rent money, rent arrears, general living expenses, to pay bills such as utility expenses, debt repayments or consolidation, working capital, or someone else’s business.

Full terms and conditions, including the repayment schedule are included in the loan offer. You should consider these before making a decision to accept any financing offer.

You might also like...

This page is to apply for Global Sisters Business Micro Loan program.

Global Sisters is in the process of developing a suite of Financial Pathways supports. In the meantime, we recommend checking out part of our Sister School program that focuses on business finances.

Money Matters – Part 5 of Sister School

For basic business finance support, we recommend Part 5 of Sister School focused on getting to know your business foundations.

Got questions? If you have any questions, email us at microloanprogram@globalsisters.org

About Instructor